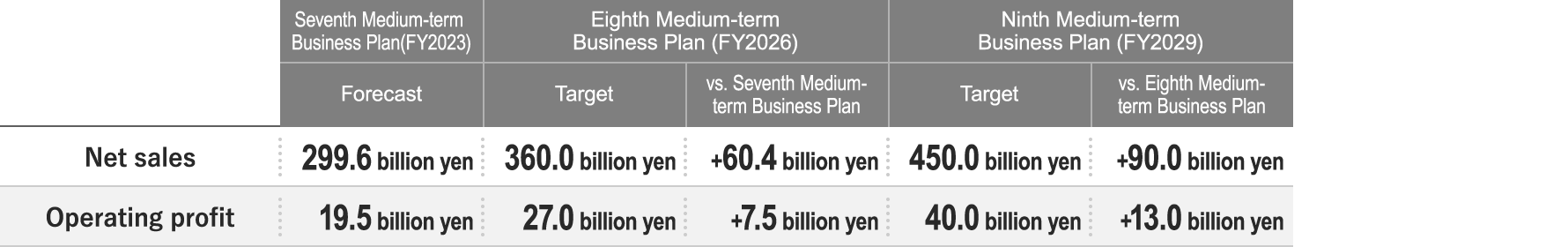

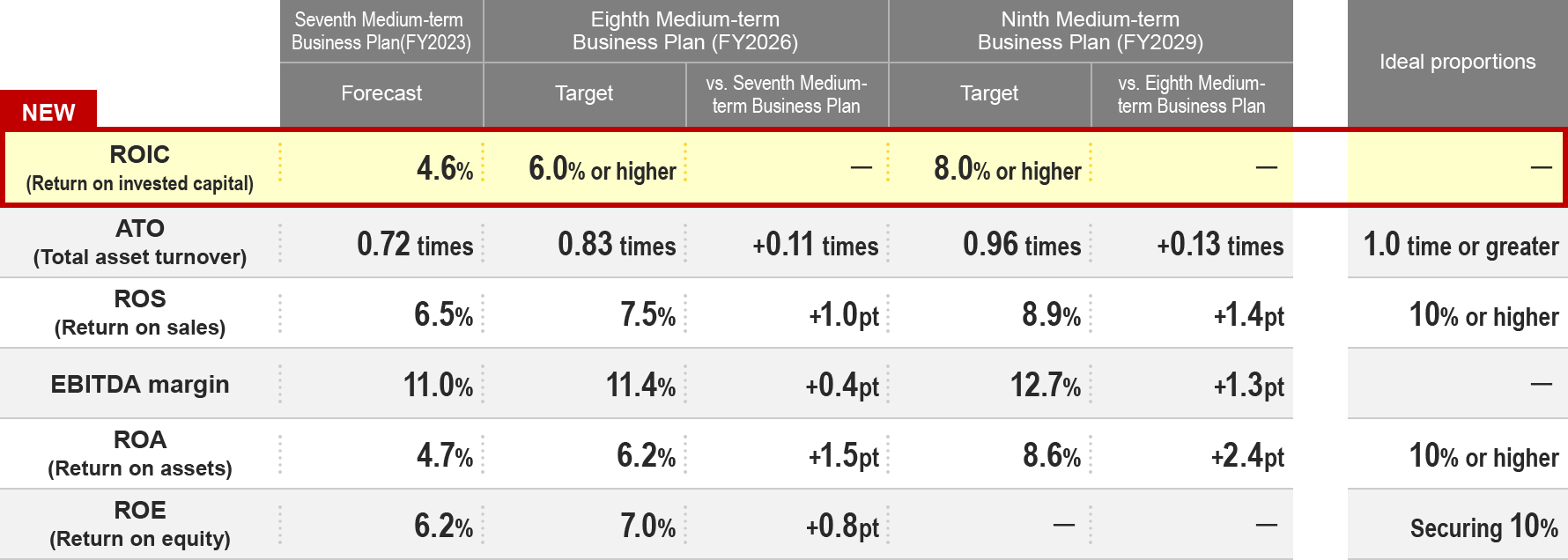

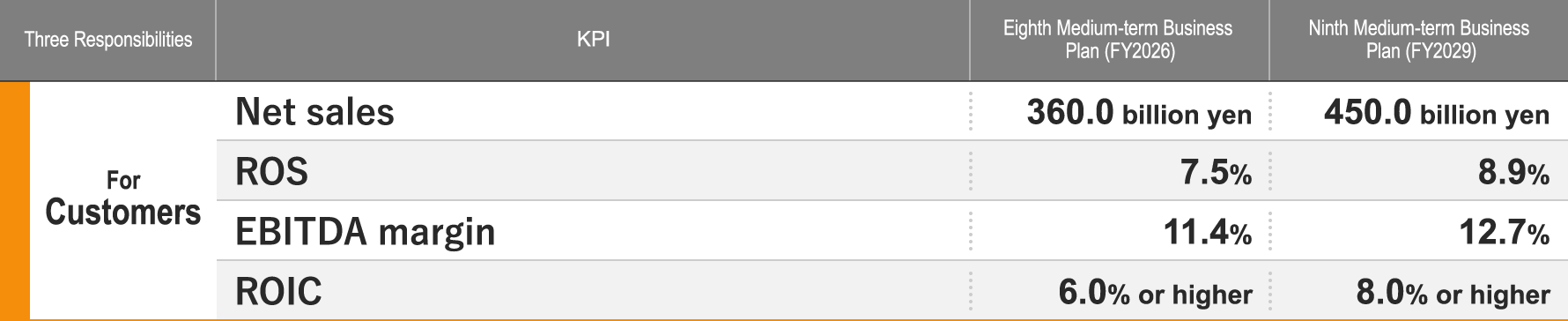

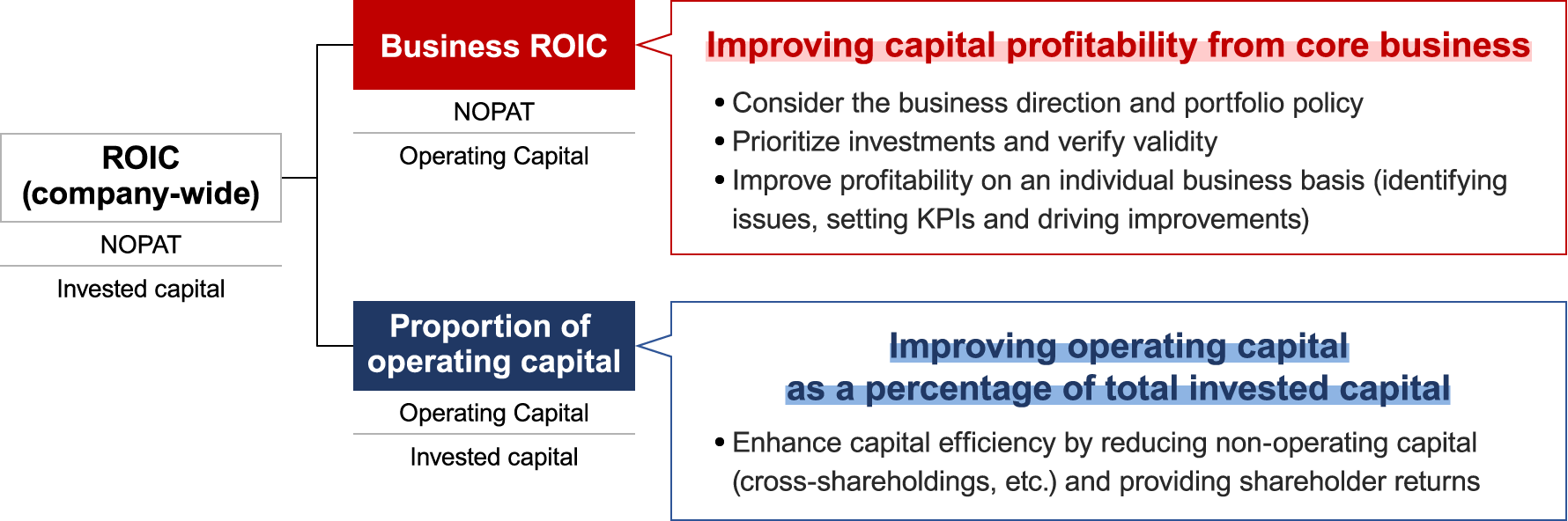

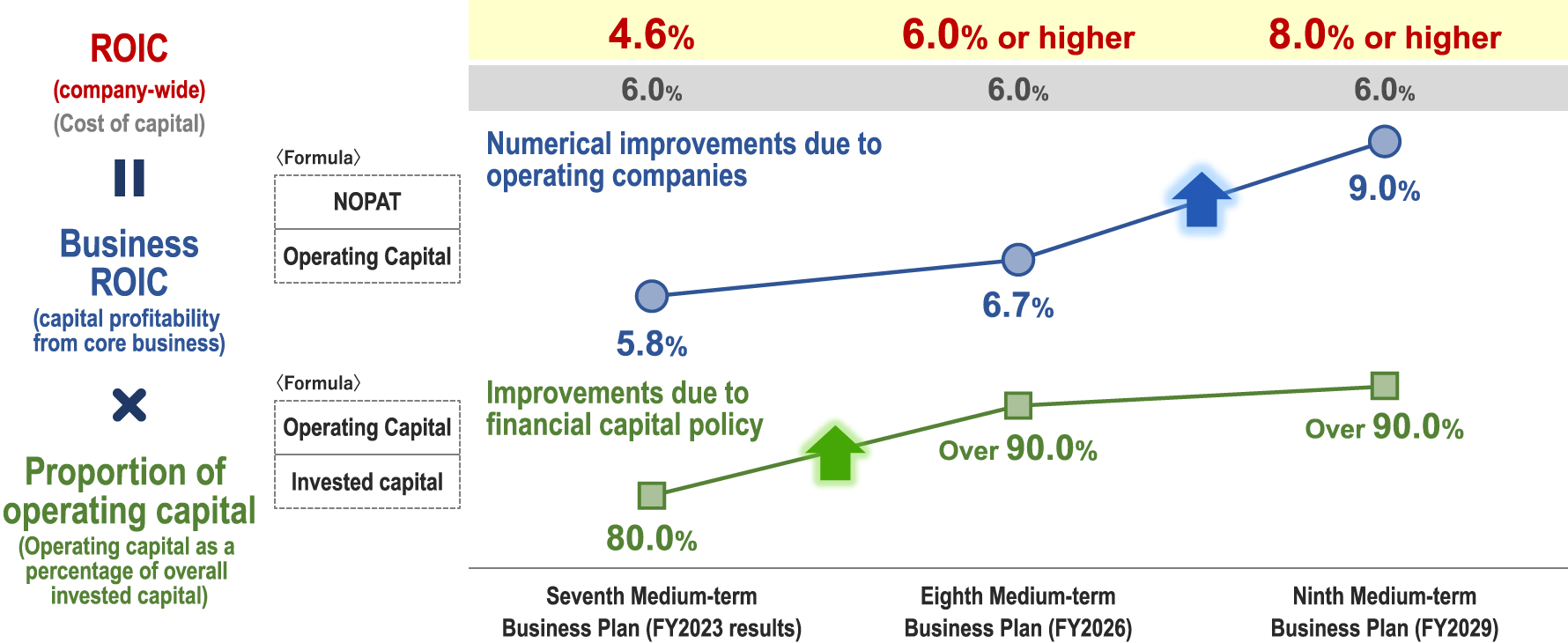

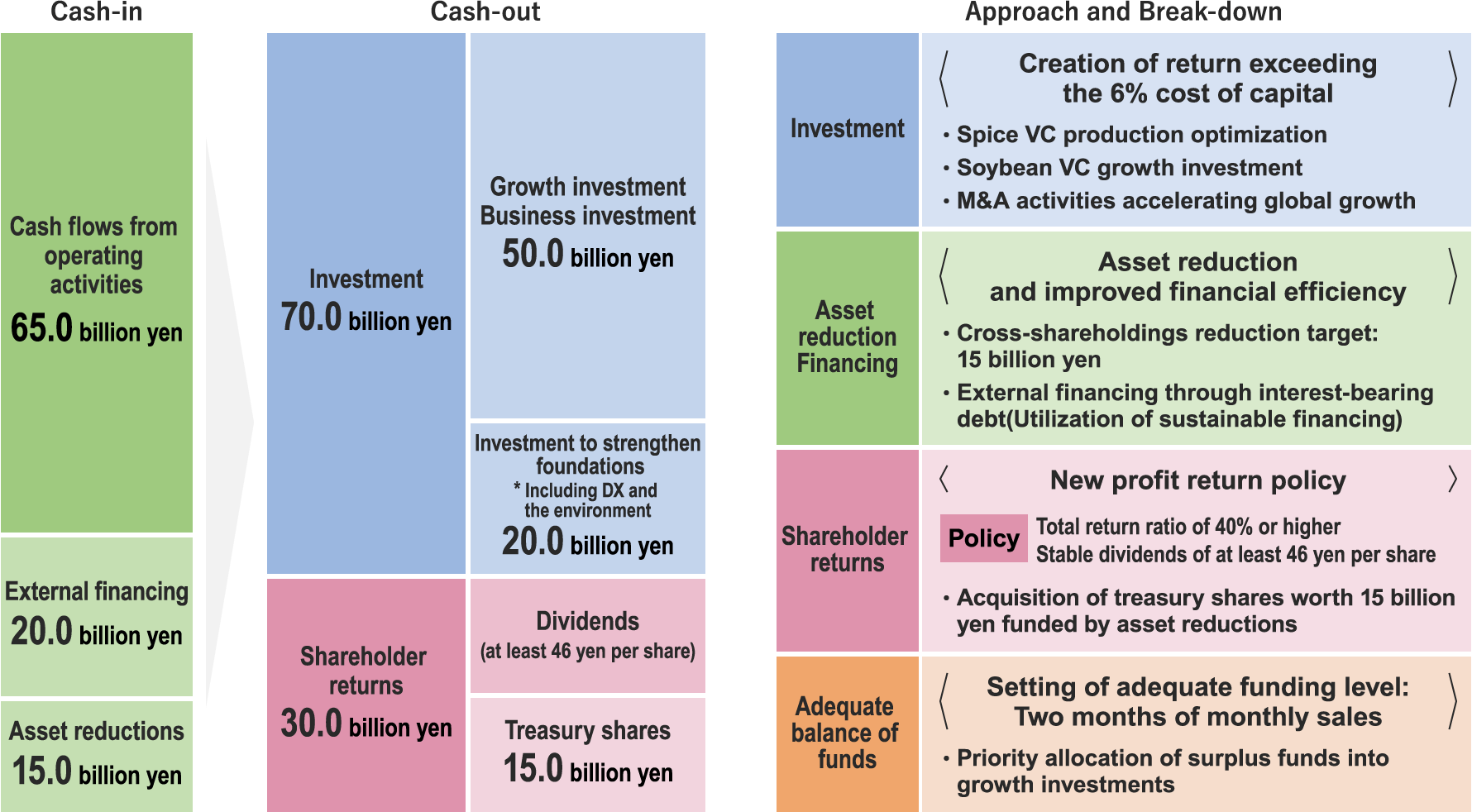

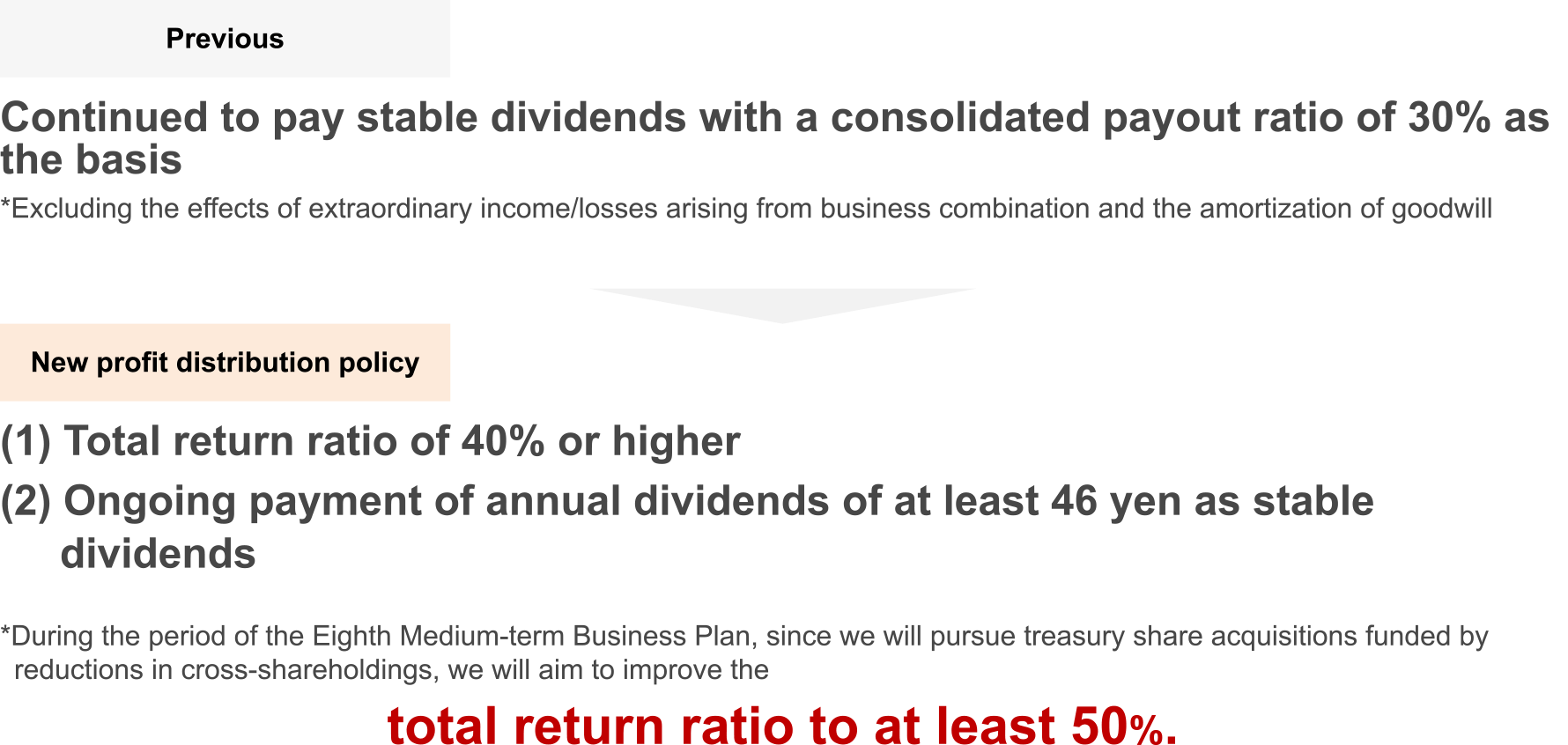

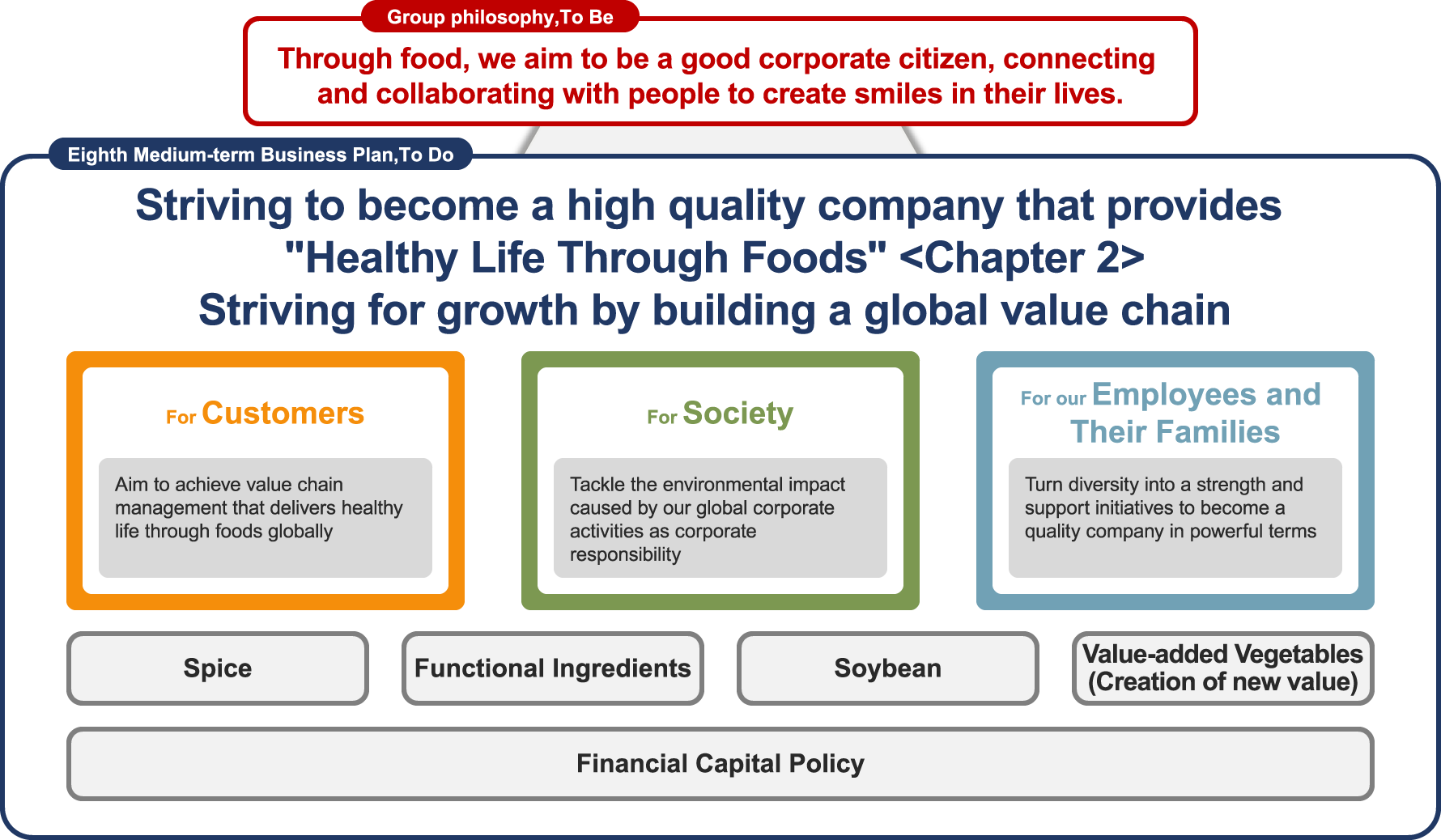

Under the Group’s Eighth Medium-Term Business Plan, launched in April 2024, in line with the theme “Striving to become a high quality company that provides “Healthy Life Through Foods” <Chapter 2> Striving for growth by building a global value chain”, the Group will build a value chain structure globally and lay foundations that will enable further growth in the future. At the same time, the Group will focus on developing a balance sheet mindset and improving management indicators, including introducing ROIC (Return on invested capital) for management that is conscious of the cost of capital.

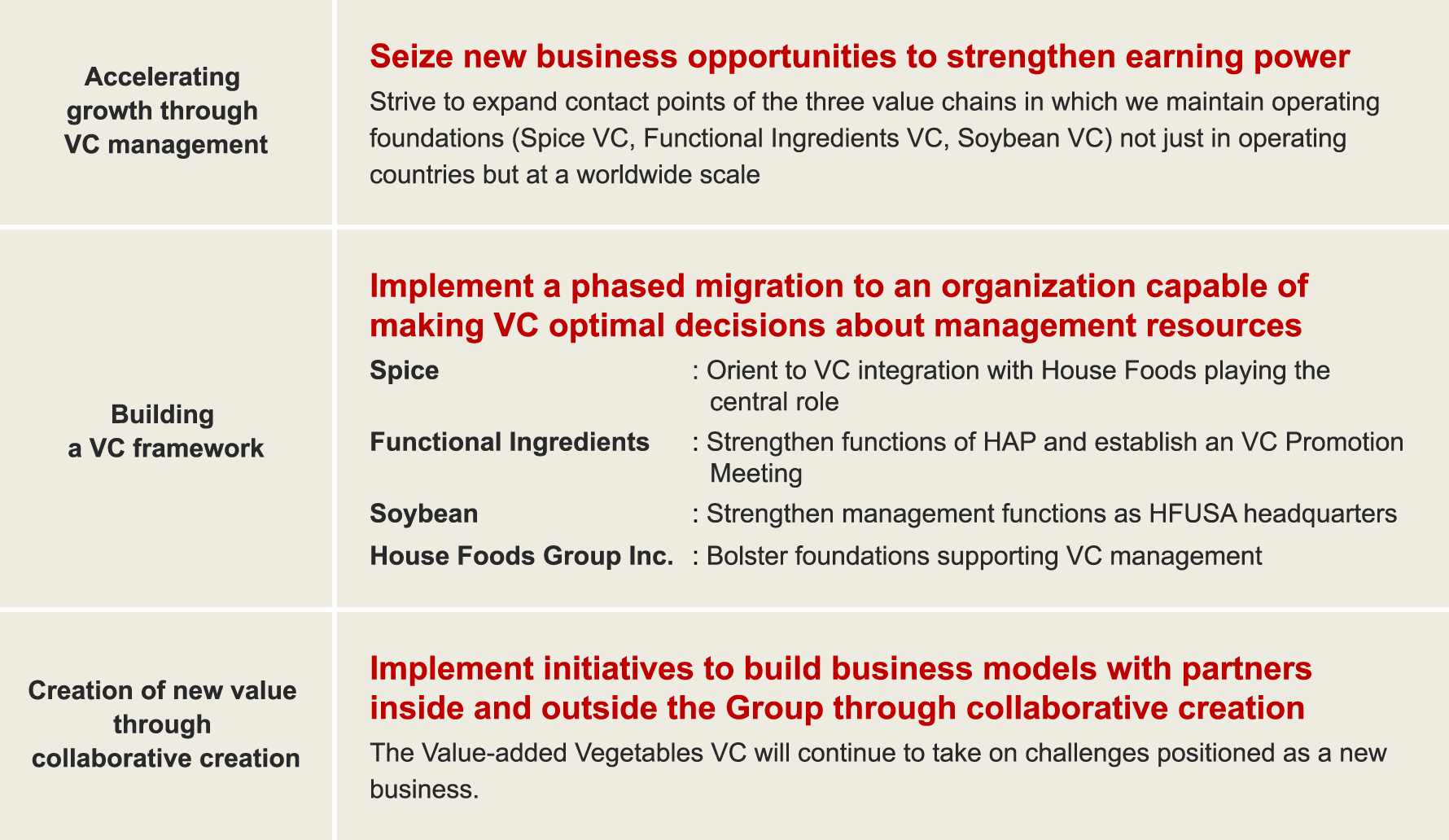

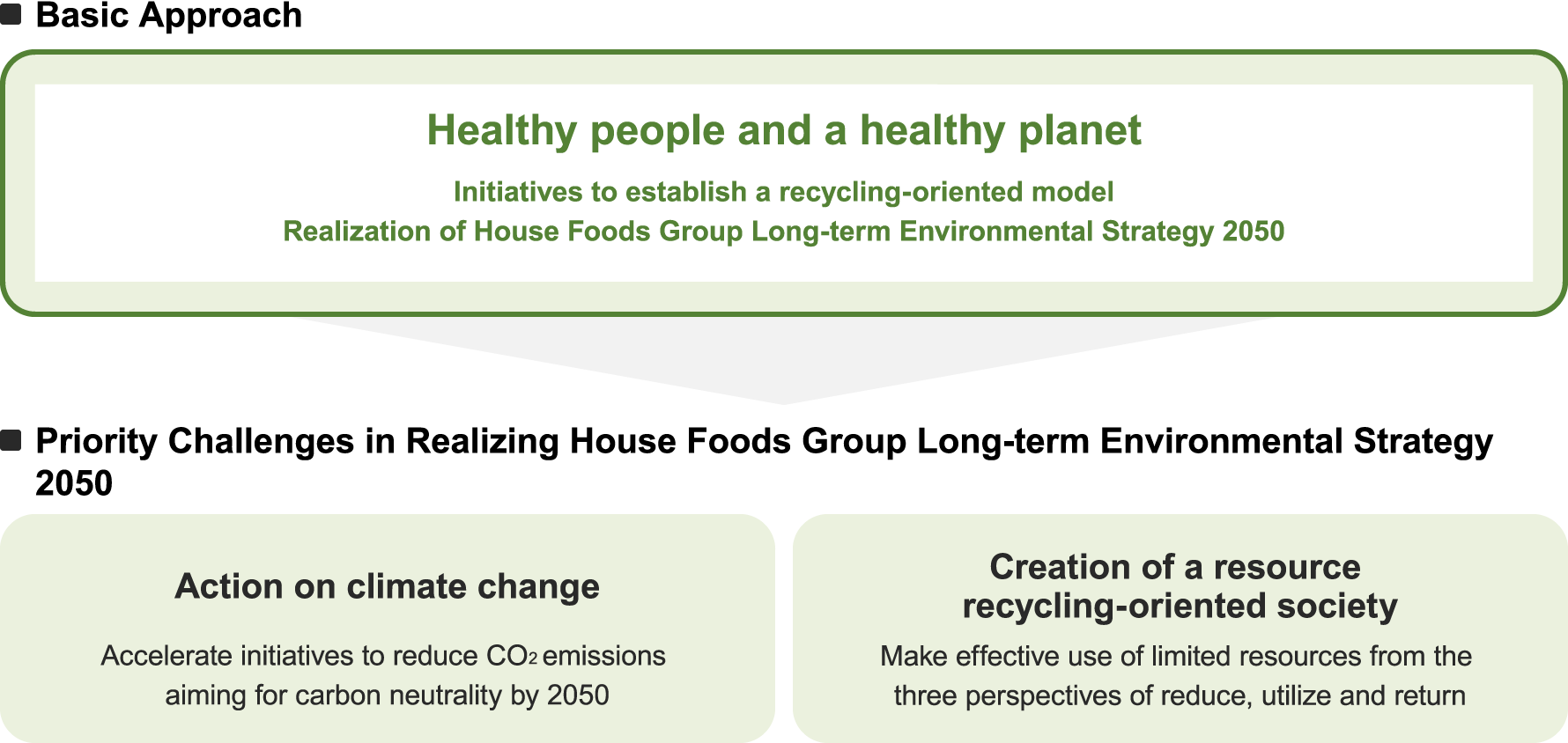

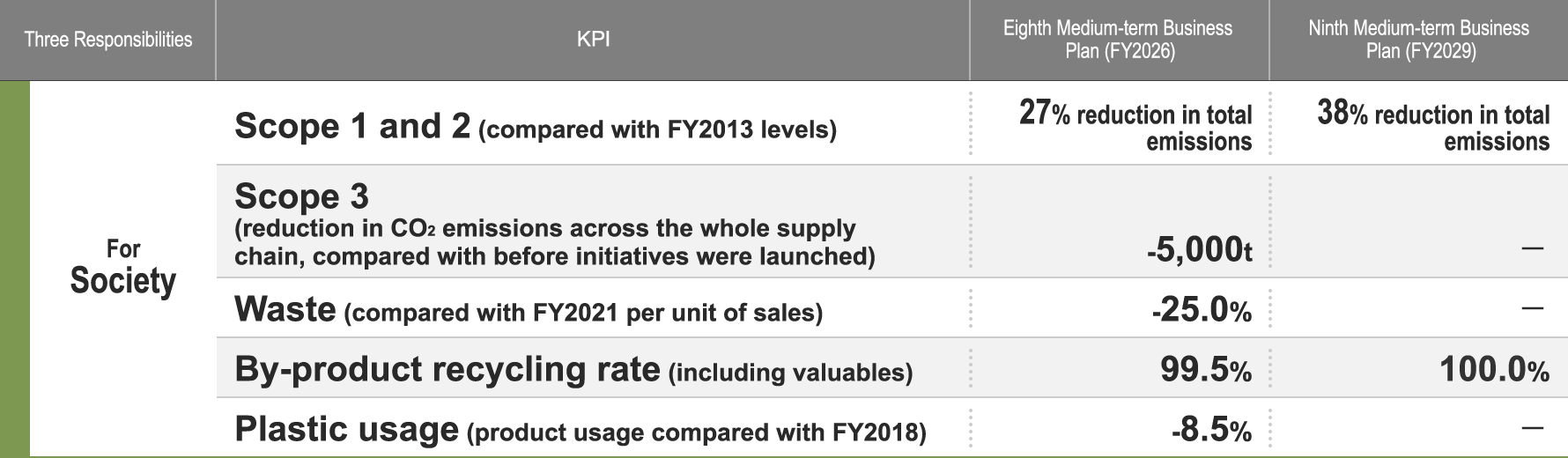

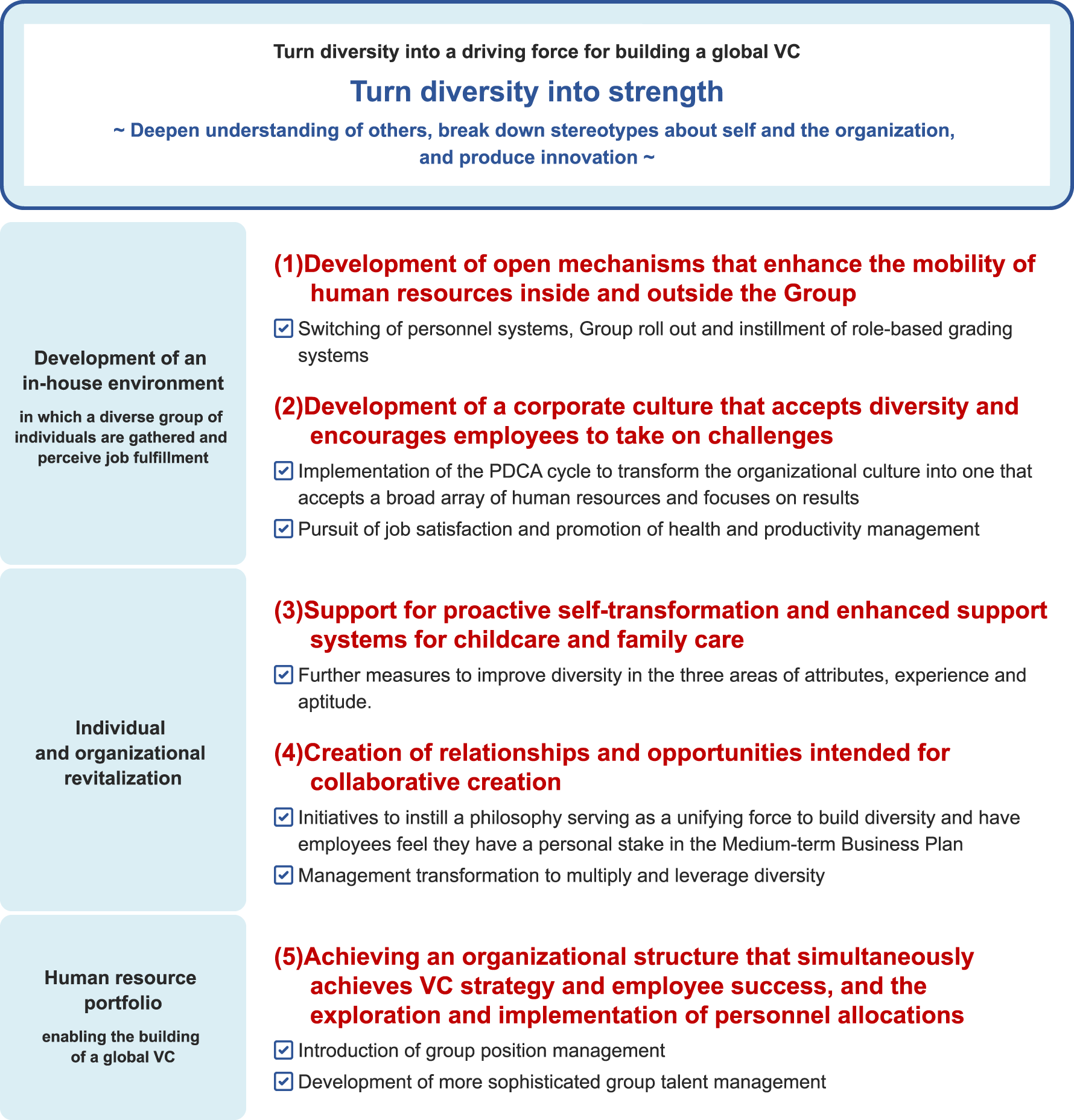

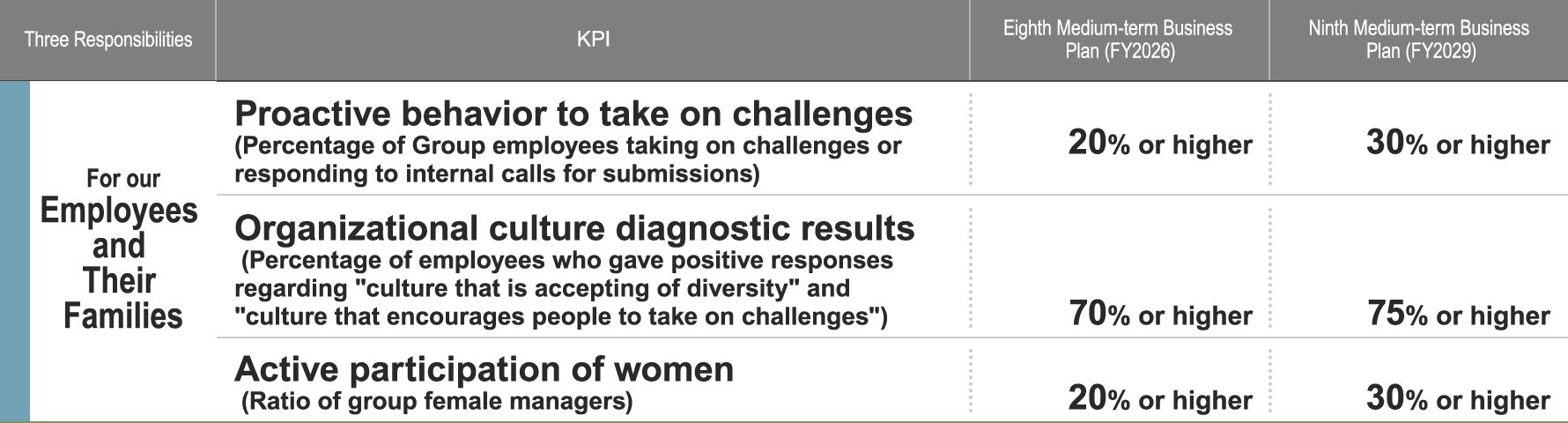

The Medium-term Business Plan has been formulated as an action plan (“To Do”) that will enable the Company to get closer to its Group philosophy (Vision, “To Be”). The Company has established “Striving to become a high quality company that provides "Healthy Life Through Foods" <Chapter 2> Striving for growth by building a global value chain*” as a major theme of the Eighth Medium-term Business Plan. Setting priority themes to address customers, society, employees and their families, respectively, the Company will push ahead to transform into a highquality company with a global presence.

The six years of the Eighth to Ninth Medium-term Business Plan are the stage for laying the foundations enabling further growth in the future.