The Group aims to enhance the adequacy and effectiveness of management and optimize its corporate value by engaging in “speedy management,” which purports to revitalize the management of organization and enable prompt decision-making. The Group positions the Three Responsibilities (for our customers, for our employees and their families, and for society) of a corporate citizen as the pillars of its business activities. These responsibilities form the basis of the Group philosophy “Through food, we aim to be a good corporate citizen, connecting and collaborating with people to create smiles in their lives.”

To properly respond to the dramatic changes taking place in the management environment, the Group has been striving through corporate management based on its philosophy to improve its transparency and its role in society, while ensuring accountability and developing a corporate governance system to ensure thorough compliance.

The Company made Ichibanya Co., Ltd. a consolidated subsidiary in December 2015. Ichibanya Co., Ltd. is a listed company, and the Company undertakes the operation of that company’s internal control system with due respect.

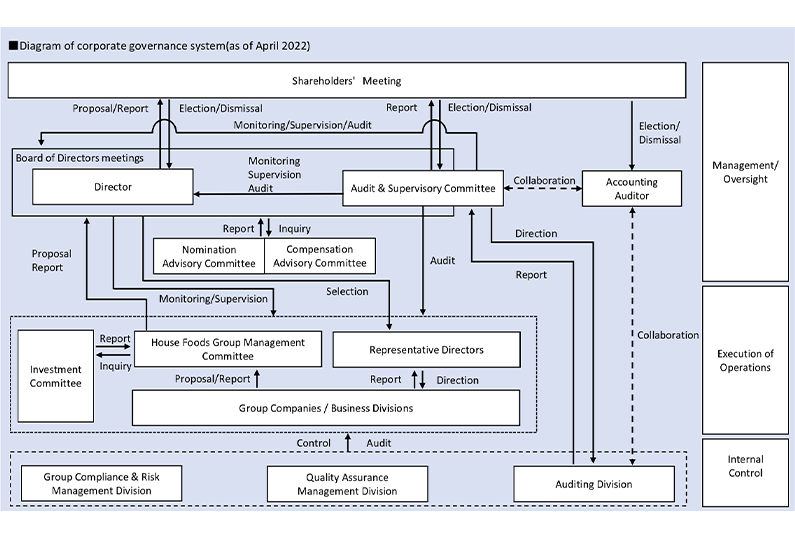

As a Company with an Audit & Supervisory Committee, the Company monitors, supervises, and audits the execution of duties by Directors and the legality and validity of resolutions by the Board of Directors via the Audit & Supervisory Committee and five Directors who are Audit & Supervisory Committee Members (of whom four are Outside Directors).

The Board of Directors consists of twelve Directors (of whom four are Outside Directors), makes decisions on the execution of important operations of the Group, and monitors and supervises the execution of operations by other Directors and Group companies.

As voluntary advisory bodies to the Board of Directors, the Company has also established the Nomination Advisory Committee and the Compensation Advisory Committee, to ensure objectivity and transparency in the election and dismissal of Directors and in the decision process for compensation. Independent Outside Directors account for a majority of the members of each of these committees, which are chaired by an Independent Outside Director.

The Audit & Supervisory Committee has the authority to give instructions to the Auditing Division, which is responsible for conducting audits of operations and implementing internal controls in respect of financial reporting, and works closely with them to confirm how the audits are conducted and how the internal control system is evaluated and regularly exchanges opinion and conducts investigation and issues specific instructions. The committee also audits the execution of duties by Directors in an organized way in cooperation with the Accounting Auditor, and, upon necessity, corporate attorneys.

Accounting audit is performed by Deloitte Touche Tohmatsu LLC. We have an audit agreement with this firm to perform audits under the Companies Act and those under the Financial Instruments and Exchange Act.

| Chair of the Board of Directors | President Hiroshi Urakami | |

|---|---|---|

| Directors who are not Audit & Supervisory Committee Members | Directors who are Audit & Supervisory Committee Members | |

| Standing Audit & Supervisory Board Member | Not more than 10 | Not more than 8 |

| Number of Directors | 7 | 5 |

| Term of Office of Director | 1 year | 2 years |

| Number of Outside Directors(Number of Independent Directors) | - | 4(4) |

| Number of female Directors | - | 2 |

| Ratio of female Directors | 16.7% | |

| Purpose | Ensure objectivity and transparency in decisions concerning the compensation system and the amounts of compensation, etc. for Directors |

|---|---|

| Chairperson | Independent Outside Director |

| Number of Committee Members | 6 Directors (of whom four are Outside Directors) |

| Held | Three times a year in principle |

| Purpose | Ensure objectivity and transparency in the decision process, such as the election and dismissal of Directors |

|---|---|

| Chairperson | Independent Outside Director |

| Number of Committee Members | 6 Directors (of whom four are Outside Directors) |

| Held | Twice a year in principle |

For new Directors, the number of meetings and attendance rate after being appointed are listed.

| Name | Board of Directors meetings (14 meetings) | Audit & Supervisory Committee (12 meetings) | Compensation Advisory Committee (4 meetings) | Nomination Advisory Committee (3 meetings) |

|---|---|---|---|---|

| Hiroshi Urakami | 100% (14/14 meetings) | - | 100% (4/4 meetings) | 100% (3/3 meetings) |

| Yoshiyuki Osawa | 100% (14/14 meetings) | - | 100% (4/4 meetings) | 100% (3/3 meetings) |

| Kotaro Kawasaki | 100% (14/14 meetings) | - | - | - |

| Yoshiyuki Miyaoku | 100% (14/14 meetings) | - | - | - |

| Tatsumi Yamaguchi | 100% (14/14 meetings) | - | - | - |

| Atsushi Sakuma | 100% (14/14 meetings) | - | - | - |

| Yuichi Okamoto | 100% (10/10 meetings) | - | - | - |

| Tsuneo Kubota | 100% (14/14 meetings) | 100% (12/12 meetings) | - | - |

| Atsuko Okajima | 100% (14/14 meetings) | 100% (12/12 meetings) | 100% (4/4 meetings) | 100% (3/3 meetings) |

| Fukuichi Sekine | 100% (14/14 meetings) | 100% (12/12 meetings) | 100% (4/4 meetings) | 100% (3/3 meetings) |

| Yasuyuki Kawasaki | 100% (10/10 meetings) | 100% (9/9 meetings) | 100% (2/2 meetings) | 100% (2/2 meetings) |

| Miwa Yamada | - | - | - | - |

With regard to the election of management executives and the nomination of candidates for Directors, suitable personnel according to the election criteria provided below shall be proposed to the Board of Directors upon deliberations by the Nomination Advisory Committee, resolved as the candidates, and then brought to the General Meeting of Shareholders for discussions.

| Directors (excluding Directors who are Audit & Supervisory Committee Members) |

・Persons who have courage to stay committed to the Group’s philosophy and mission statement ・ Persons who have the knowledge, experience and ability to engage in management ・ Persons who aim to enhance the corporate value, and who have the driving force to achieve performance targets ・ Persons with an excellent human nature appropriate for a Director of the Company |

|---|---|

| Directors who are Audit & Supervisory Committee Members | ・ Persons who possess the ability to carry out an audit based on extensive experience and insight ・ Persons with an excellent human nature appropriate for an Audit & Supervisory Committee Member of the Company |

Personnel who are to serve as Directors in the future receive practical OJT mainly through gaining experience as directors of business companies as well as OFF-JT mainly through executive development programs and internal training, as part of the Company’s efforts to nurture successors. If the Board of Directors determines that a management executive is not consistent with the election criteria, dismissal will be resolved by the Board of Directors and presented to the Shareholders’ Meeting for discussion.

The skills of the Board of Directors are identified as skills that should provide the functions necessary for corporate management as the House Foods Group. In addition, the Board of Directors is to be composed of persons of diverse expertise and various experiences, regardless of age or gender, and is to be of a size that ensures flexible decision-making and mutual supervision.

| Name | Position | Expertise and experience required for a Director in supervision and execution | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate Management | Personnel affairs and Diversity | Finance and Accounting | Legal affairs, Compliance and Risk | Public relations, investor relations | Sustainability | R&D and intellectual property | Global Business | Digital Technology and DX | Quality Assurance | Production and Procurement | Sales, Marketing and Advertisement | Management of other companies | ||||

| 1 | Hiroshi Urakami |

|

Representative Director & President | ● | ● | ● | ● | |||||||||

| 2 | Yoshiyuki Osawa |

|

Representative Director & Senior Managing Director | ● | ● | ● | ● | ● | ● | |||||||

| 3 | Kotaro Kawasaki |

|

Senior Managing Director | ● | ● | ● | ● | ● | ||||||||

| 4 | Yoshiyuki Miyaoku |

|

Director | ● | ● | ● | ● | ● | ● | ● | ● | |||||

| 5 | Tatsumi Yamaguchi |

|

Director | ● | ● | ● | ● | ● | ● | |||||||

| 6 | Atsushi Sakuma |

|

Director | ● | ● | ● | ● | ● | ● | ● | ||||||

| 7 | Yuichi Okamoto |

|

Director | ● | ● | ● | ||||||||||

| 8 | Tsuneo Kubota |

|

Director (Audit & Supervisory Committee member; full time) | ● | ● | |||||||||||

| 9 | Atsuko Okajima |

|

Director (Audit & Supervisory Committee member; outside) | ● | ● | |||||||||||

| 10 | Fukuichi Sekine |

|

Director (Audit & Supervisory Committee member; outside) | ● | ● | ● | ● | ● | ||||||||

| 11 | Yasuyuki Kawasaki |

|

Director (Audit & Supervisory Committee member; outside) | ● | ● | ● | ● | ● | ● | |||||||

| 12 | Miwa Yamada |

|

Director (Audit & Supervisory Committee member; outside) | ● | ● | ● | ● | |||||||||

As our basic policy, the compensation system and the amounts of compensation, etc. for Directors (excluding Directors who are Audit & Supervisory Committee Members) are based on the following points: “it gives motivation for the enhancement of corporate value and sustainable growth, and for achieving the Medium-Term Business Plan in order to realize the Group’s Philosophy,” “it is commensurate with the role and responsibilities of the position held, in light of the size of the company and its social responsibilities,” and “objectivity and transparency are ensured in the decision process of compensation.” They are determined by the Board of Directors after deliberations of the Compensation Advisory Committee.

The compensation system and the amounts of compensation, etc. for the Directors who are Audit & Supervisory Committee Members are deliberated by the Compensation Advisory Committee at the request of the Audit & Supervisory Committee, and after the deliberation results are reported to the Audit & Supervisory Committee, determined by consultation among the Directors who are Audit & Supervisory Committee Members.

| Compensation type | Evaluation indicators, method of payment, etc. | Percentage of compensation | Performance-linked | ||

|---|---|---|---|---|---|

| Fixed compensation | Add compensation according to the role to the compensation level determined by position, and pay as monthly compensation | 60% | |||

| Short-term incentives | Single-year performance-linked compensation | Evaluation of company performance | Based on the indicator determined by the Board of Directors, evaluate the degree of achievement of the relevant indicator for the Group or the operating company each Director is responsible for on a single fiscal-year basis, and pay as bonuses according to the results of the evaluation | 25% | ○ |

| Evaluation of individual performance | Define the degree of achievement of targets set by each Director as an evaluation indicator, and pay as bonuses according to the degree of achievement | ||||

| Medium- to long-term incentives | Advance-issue-type restricted stock compensation | Pay for the purpose of motivation for the continuous improvement of corporate value and further encouraging value sharing with shareholders of the Company | 10% | ||

| Performance-linked, restricted stock compensation | In addition to the above, pay for the purpose of better incentivizing to Executive Directors to achieve the medium-term business plans (adopt non-financial indicators prescribed in medium-term business plans as evaluation indicators for the stock compensation) |

5% | ○ | ||

Compensation for Directors who are Audit & Supervisory Committee Members consists of only fixed compensation.

<Outline of the linkage with performance for Directors (excluding Directors who are Audit & Supervisory Committee Members)>

The Company has Ichibanya Co., Ltd. (hereinafter "Ichibanya") as a listed subsidiary.

The business of Ichibanya and each of the Group's businesses compliment each other, having strong linkages in the value chain, and the Company pursues maximum synergies on a groupwide basis whilst also exercising supervision as the parent company, including dispatching directors of the Company as part-time directors of Ichibanya, ensuring that the business results of Ichibanya are routinely reported at the Company's Management Committee meetings and Board of Directors meetings, and making the approval or disapproval of proposals to be put before Ichibanya's General Meeting of Shareholders a matter for resolution by the Company's Management Committee. At the same time, the Company respects the independent decisions made by Ichibanya's management on the execution of day-to-day operations given that Ichibanya's business model is very different from that of the Group's core business. Further, Ichibanya is a company with an Audit & Supervisory Committee and makes decisions on important transactions with the Group based on the views of the Audit & Supervisory Committee, thus preventing any unfair disadvantage to other shareholders (besides the Company).

The Company and the subsidiary whose business models are different strengthen collaboration and promote cooperation themes together while respecting each other’s uniqueness, thereby enabling three parties including franchise owners who are engaged in the management of stores to enjoy benefits together. In this way, the Company believes that it will contribute to bringing benefits also to other shareholders of the subsidiary. Therefore, the Company’s policy is to keep both itself and the subsidiary listed while ensuring the effectiveness of the corporate governance system of the subsidiary.

The Group sees the internal control system as a framework for enhancement of the corporate governance structure and realization and achievement of its corporate philosophy and management targets and the Group implements initiatives intended to lead to improvement in corporate value and sustainable development through the establishment and accurate and effective operation of the internal control structure.